And ends in N.... correct guess will win a small prize...

Basic-own-brand-cheap-bargain-multimeter-from-Amazon ?

B&K Presision ?

And ends in N.... correct guess will win a small prize...

Lol... got two cheapies... both have differing opinions about DC volts...not B&K precisioN...?Basic-own-brand-cheap-bargain-multimeter-from-Amazon ?

B&K Presision ?

Hi SeaGal..Basic-own-brand-cheap-bargain-multimeter-from-Amazon ?

B&K Presision ?

Yes 60 euros each ex vat, shipping was 230 I think. VAT will be +20% for me.ah thanks, so they are 60 euro each? plus shipping about 200 euro? and you're allowing for vat on import?

Sounds good. I may look into doing this. Do you have a named contact there who agreed they would do it? Ive got eori for my company as have done a few imports. Also want 32 cellsYes 60 euros each ex vat, shipping was 230 I think. VAT will be +20% for me.

I was dealing with Roan and Jeffrey Peeters Roan van Diepenbeek.Sounds good. I may look into doing this. Do you have a named contact there who agreed they would do it? Ive got eori for my company as have done a few imports. Also want 32 cells

My brain cannot work this out...UPDATE 2...

I have been playing with some layouts that will fit into my space. This is the best one I have so far. I have a 5kw hybrid inverter (plus a separate 3kw standard inverter). Max current is 100A but am using 200A BMS. I have battery post and extra bus bars on way from aliexpress.

View attachment 185293

So you’ve paralleled 2 cells... and then put 16 of them in series... I would have leaned more towards a bog standard 2 pack of 16s... then if one pack is down then you still have a pack to power the inverter..never thought of this approach...UPDATE 2...

I have been playing with some layouts that will fit into my space. This is the best one I have so far. I have a 5kw hybrid inverter (plus a separate 3kw standard inverter). Max current is 100A but am using 200A BMS. I have battery post and extra bus bars on way from aliexpress.

View attachment 185293

So the whole pack can be run with a single bms... I like it..?So you’ve paralleled 2 cells... and then put 16 of them in series... I would have leaned more towards a bog standard 2 pack of 16s... then if one pack is down then you still have a pack to power the inverter..never thought of this approach...

Yet, you loose the ability to see a single cell failure..So the whole pack can be run with a single bms... I like it..?

Also valid points...Yet, you loose the ability to see a single cell failure..

Failures can cause heat, heat causes more issues to other cells / inverters / houses.

Unless using certified automotive grade cells, I'd skip on that and rather spend some extra on an extra BMS..

Just my 2 cents

See here where that Rabbit Hole leads to ;Also valid points...

So when ive done it before then the courier does the clearance and charged about £30-50 admin fee on top of the duty and vat. I had no choice to use a different import agent on that one. Mostly i was annoyed how long they took. Another much bigger shipment was from myself to myself, i nominated the clearance agent and they were much more efficient but probably twice the price. More complicated that ine, as was mixture of personal effects and company equipment.I was dealing with Roan and Jeffrey Peeters Roan van Diepenbeek.

It's coming to the crunch now though. I have received the delivery notification and forms to complete from Gerlach who I think operate on behalf of DHL for customs clearance. Not that I appointed them or asked for that.

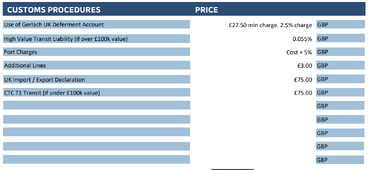

They are asking for a lot of info I don't know how to supply and have a ridiculous sheet of charges I have to agree to, which will total more than the VAT and duty. So I'm questioning them on that because it seems unreasonable - just using their deferment account would be ~250 alone.

View attachment 185289

I currently have a cash CDS account, I did not sign up for a deferment account because it takes 30 days with various financial paperwork with a wavier. Import declarations elsewhere seem to be £15-20 not 75. Does anyone have experience with this part? I had planned to use someone else but this has all happened without me requesting.

The HMRC website is very disjointed for this and appears to offer no way to do an import declaration without using specialist software. The only declaration you can make on HMRC directly is for when you are bringing it with you over the border (https://www.gov.uk/bringing-goods-into-uk-personal-use/declaring-goods). When I called HMRC, they didn't have a clue, and scheduled a call back which I never received.

The whole whole thing seems to be missing a simple route for one-off individual imports.

I’m working my way through this thread... I’ve still a lot to think about...See here where that Rabbit Hole leads to ;

Last fire.. :-(

Last week we had a nasty fire. I worked for months, used only high quality materials, tinned silicone wire that self fuses at 10A, and weeks between each step of construction to be absolutely sure things are safe The lower layer was good. Might look a mess with the wires, but absolutely safe...diysolarforum.com

Did they send a bunch of paperwork through to complete or did you just receive an invoice to pay?So when ive done it before then the courier does the clearance and charged about £30-50 admin fee on top of the duty and vat. I had no choice to use a different import agent on that one. Mostly i was annoyed how long they took. Another much bigger shipment was from myself to myself, i nominated the clearance agent and they were much more efficient but probably twice the price. More complicated that ine, as was mixture of personal effects and company equipment.

...I have received the delivery notification and forms to complete from Gerlach who I think operate on behalf of DHL for customs clearance. Not that I appointed them or asked for that.

They are asking for a lot of info I don't know how to supply and have a ridiculous sheet of charges I have to agree to, which will total more than the VAT and duty. So I'm questioning them on that because it seems unreasonable - just using their deferment account would be ~250 alone.

View attachment 185289

in the second instance there was a lot of paperwork. the single item imported just needed EORI and they sent invoice for payment. The admin fees werent as high as that. Possibly a postbrexit thing idk. They do have you in a bind so no need for them to be competitive.Did they send a bunch of paperwork through to complete or did you just receive an invoice to pay?

i don't know what the deferment account is, can you avoid this by paying now?Did they send a bunch of paperwork through to complete or did you just receive an invoice to pay?

so from my brief research i dont think you need the deferment account if you pay all charges now.I was dealing with Roan and Jeffrey Peeters Roan van Diepenbeek.

It's coming to the crunch now though. I have received the delivery notification and forms to complete from Gerlach who I think operate on behalf of DHL for customs clearance. Not that I appointed them or asked for that.

They are asking for a lot of info I don't know how to supply and have a ridiculous sheet of charges I have to agree to, which will total more than the VAT and duty. So I'm questioning them on that because it seems unreasonable - just using their deferment account would be ~250 alone.

View attachment 185289

I currently have a cash CDS account, I did not sign up for a deferment account because it takes 30 days with various financial paperwork with a wavier. Import declarations elsewhere seem to be £15-20 not 75. Does anyone have experience with this part? I had planned to use someone else but this has all happened without me requesting.

The HMRC website is very disjointed for this and appears to offer no way to do an import declaration without using specialist software. The only declaration you can make on HMRC directly is for when you are bringing it with you over the border (https://www.gov.uk/bringing-goods-into-uk-personal-use/declaring-goods). When I called HMRC, they didn't have a clue, and scheduled a call back which I never received.

The whole whole thing seems to be missing a simple route for one-off individual imports.